Why Choose Us?

We can help you work smarter, not harder

Be better informed and make credit decisions with confidence

The biggest threat to your business is a lack of timely and accurate information. Without all the facts, you’re pressurised into making critical business decisions and find yourself assessing risks based on guesswork, resulting in financial losses and missed opportunities. Our suite of 3 reports can provide you with essential corporate facts combined with our expert analysis so you can be confident in making the right decisions.Get all the essential facts

- We gather our data from the most reliable sources, which include the following sources:

- Company registration offices

- Other government departments

- Trade, industry and telephone directories

- Banks

- Courts

- Press articles

- Debt collection agencies

- Interviews with key managers in Subject company

- Trade partners of Subject company

- PEPS, Sanctions and adverse media databases

Expert analysis that you can trust

Our in-house team of analysts will sift through the data to ensure its accuracy and relevance, and carefully analyse:

- The stability of the Subject company’s organisational structure

- The experience and capabilities of management

- Any detrimental public records or negative events

- Financial performance and trends

- Operational size, capabilities and industry trends

Payment history with trade partners

Our credit scoring – the bottom line

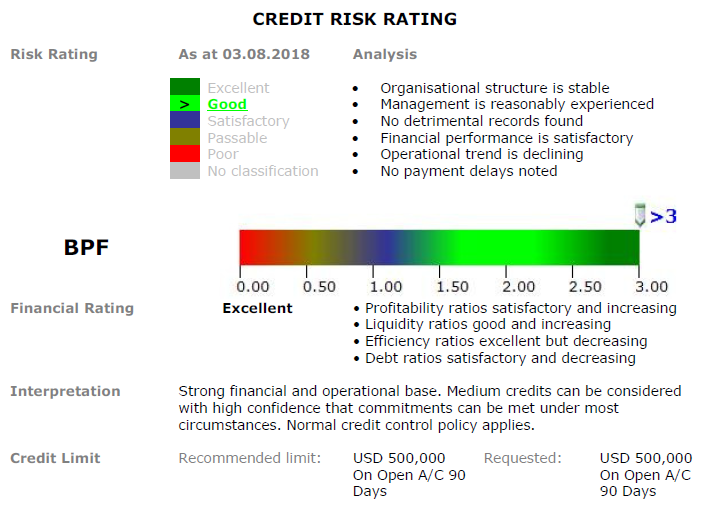

All our reports, except the Registry Extract, provide a credit risk scoring using a judgemental scoring system. Based on an analysis of the factors described above, you will be provided with:

- A risk scoring, showing the overall position of the Subject company within a 6 level risk scale

- A summary analysis of key factors from which this scoring is derived.

- An interpretation of what this means in terms of the probability that a company will remain solvent within the next 12 months and be able to meet its obligations, plus a recommendation on the stringency of your credit control method.

- Our opinion whether open credit is acceptable, if so, a recommended maximum credit limit benchmarked against your requested limit if provided

- Additionally, when full financial statements are available, we have introduced an additional scoring system named BPF or Bankruptcy Probability Factor (within 2 years) which is based purely on an analysis of accounts. When both scoring methods are used you obtain a unique blend of expert analysis that proves to be correct in nearly any case.

An example:

Lowest prices, pay-as-you go

- We offer unbeatable prices on a pay-as-you basis plus volume discounts and easy payment options: credit card, monthly invoice or pre-payment.

- There are no binding contracts.

Reports on ANY business ANYWHERE

- We can report and retrieve documents on more than 240 million companies.in 238 countries across the world.

- We do not supply out of date reports, instead they are always freshly investigated

Monitoring Service – Stay in touch

- As an optional feature, we offer a monitoring service whereby we will automatically send you 1 updated report after 6 months or 3 quarterly updated reports from the date of the original order.

Fast and reliable delivery

- We can guarantee 99.5% SLA delivery for our freshly investigated reports

- “Same Day” delivery in 61 countries is available for our Standard Credit Report.